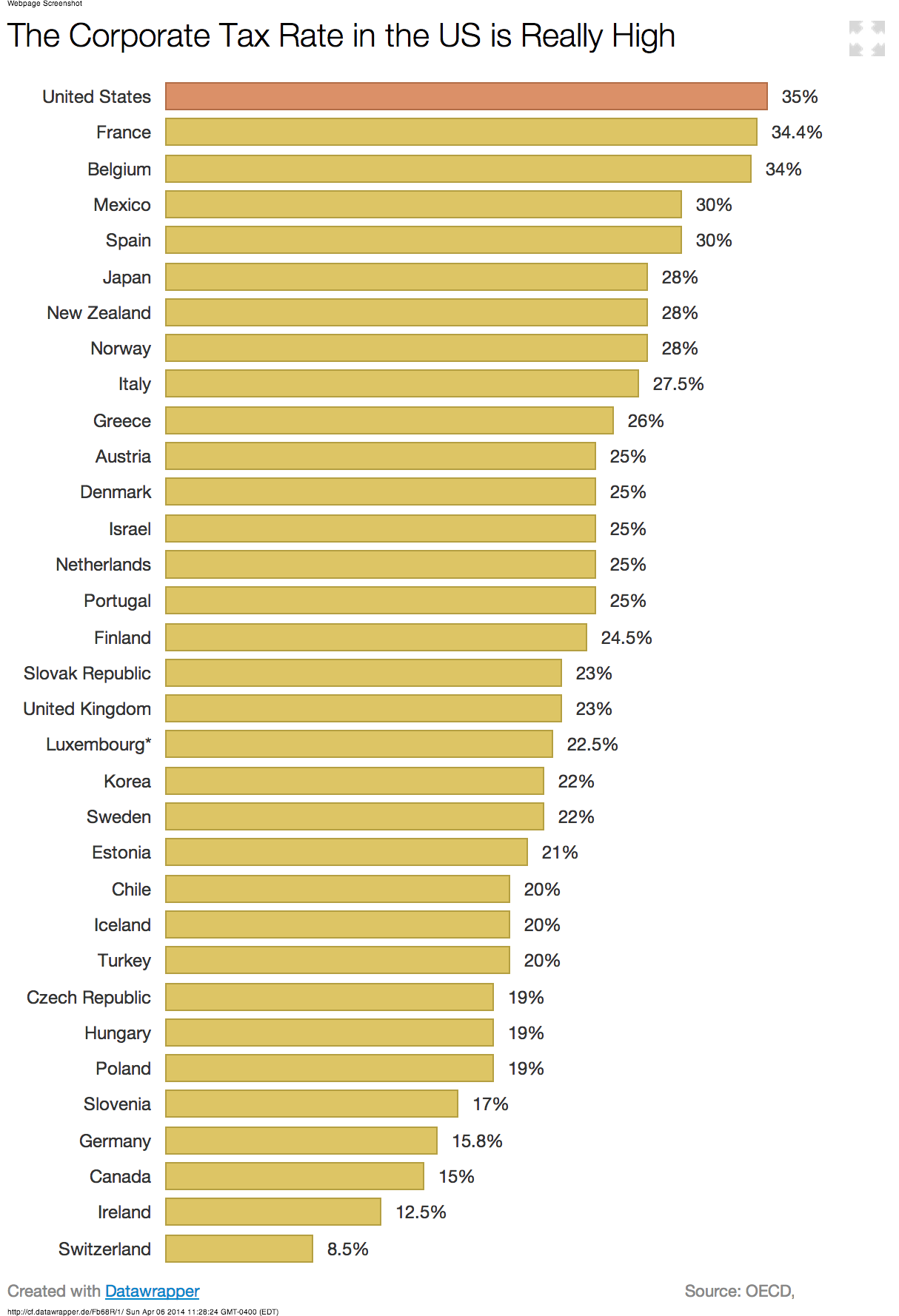

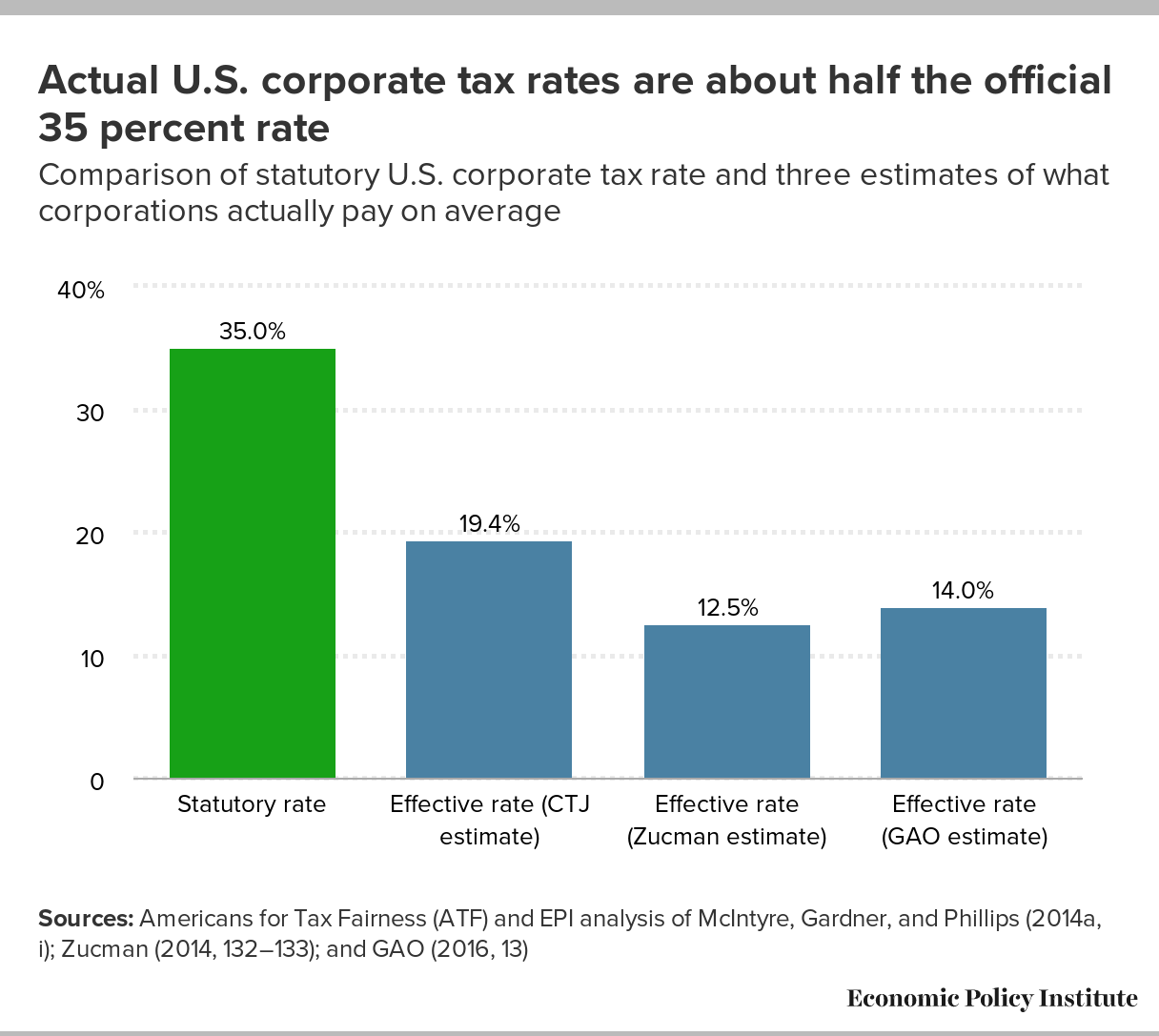

Corporations pay between 13 and 19 percent in federal taxes—far less than the 35 percent statutory tax rate | Economic Policy Institute

What Is the Average Federal Individual Income Tax Rate on the Wealthiest Americans? - CEA - The White House